Latest Business News Across Africa

Want to know what’s shaking up Africa’s business scene today? You’re in the right place. Here we break down the biggest headlines, from booming fortunes to bold deals, in a way that’s quick to read and easy to understand.

Johan Rupert’s Wealth Jumps $2.7 Billion

South Africa’s richest man, Johan Rupert, saw his net worth climb by $2.7 billion in 2025. The spike came as shares of his luxury group, Richemont, surged. Strong sales of watches and jewelry helped the stock climb, pushing Rupert’s fortune to $16.1 billion. That makes him the country’s top billionaire and the continent’s runner‑up after Aliko Dangote.

Richemont’s focus on high‑end brands has paid off. Investors responded to better profit margins and new product launches. If you follow the luxury market, Rupert’s rise is a clear sign that premium goods still have strong demand, even when the broader economy feels pressure.

Sanlam’s Strategic Move: Buying a 25% Stake in African Rainbow Capital

Sanlam Life Insurance announced a plan to buy a 25 % share in African Rainbow Capital Financial Services. The target holds interests in companies like TymeBank, which is growing fast in the digital banking space. By joining forces, Sanlam aims to expand its footprint in South Africa’s financial sector and meet B‑BBEE requirements.

The deal still needs regulator approval, but the idea is simple: combine Sanlam’s capital with African Rainbow’s fintech expertise. That should help both companies launch new products and reach more customers, especially in under‑served communities.

These two stories illustrate a broader trend – South African firms are using wealth and strategic partnerships to push into new markets. Whether it’s luxury items or digital finance, the goal is the same: grow faster and stay ahead of the competition.

Beyond these headlines, the African business landscape is buzzing with other developments. Energy projects, agriculture tech, and cross‑border trade agreements are all part of a fast‑moving ecosystem. Keeping an eye on these moves can give you a leg up whether you’re an investor, entrepreneur, or just curious about the region’s economy.

So, what does this mean for you? If you’re looking to invest, consider sectors where growth is backed by real demand – like luxury goods with strong brand loyalty or fintech platforms that solve everyday banking problems. If you’re a business owner, watch for partnership opportunities that can help you scale quickly.

Stay tuned to Quarry Lake Daily News for more updates. We’ll keep breaking down the numbers, explaining the deals, and giving you the context you need to make sense of Africa’s business world. No jargon, just the facts that matter.

Access Bank Restores Services After Nationwide Outage Following Oracle Upgrade

Access Bank Plc restored all digital services on Feb 24, 2025 after a day‑long outage caused by its Oracle Flexcube upgrade, affecting millions of customers across Nigeria.

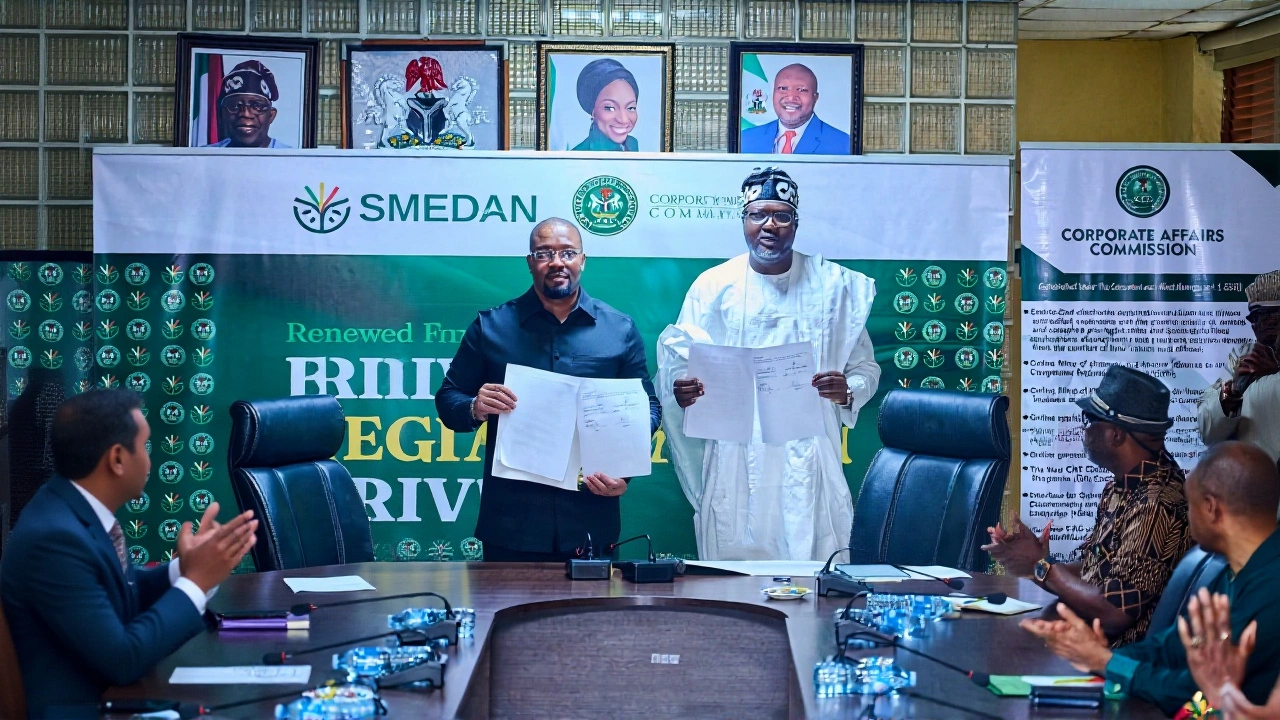

Nigeria's CAC & SMEDAN Offer Free Registration to 250,000 MSMEs

Nigeria’s CAC and SMEDAN launch a free registration scheme for 250,000 MSMEs, waiving ₦3 billion in fees to shift informal firms into the formal economy.

Johan Rupert's Wealth Jumps $2.7 Billion as Richemont Stock Booms in 2025

Johan Rupert’s wealth soared by $2.7 billion in 2025 thanks to Richemont’s surging stock and growing jewelry sales. The billionaire’s fortune now stands at $16.1 billion, cementing his status as South Africa’s wealthiest and the continent’s runner-up to Aliko Dangote. Richemont's focus on key luxury brands led to robust profits.

Sanlam's Strategic Move: Acquiring 25% Stake in African Rainbow Capital Financial Services

Sanlam Life Insurance has announced its plan to acquire a 25% stake in African Rainbow Capital Financial Services Holdings Proprietary Limited, which holds interests in financial companies like TymeBank. This move aligns with Sanlam's strategy to enhance its presence in South Africa's financial sector and complies with the country's B-BBEE policies. Subject to regulatory approval, the acquisition aims to foster growth and economic empowerment.