Nigeria MSME Registration: A Practical Guide

When working with Nigeria MSME registration, the official process of recording a small or medium enterprise with Nigerian authorities. Also known as SME business registration, it grants legal status, tax benefits, and opens doors to financing.

Key Steps and the Role of Core Agencies

The first move is to file your application with the Corporate Affairs Commission, Nigeria’s regulator that handles company incorporation and registration. The CAC portal lets you reserve a name, submit the Memorandum and Articles of Association, and pay the registration fee online. Once the CAC issues the Certificate of Incorporation, you can move to the tax registration stage at the Federal Inland Revenue Service. Nigeria MSME registration also often involves a digital registration portal that streamlines document uploads and real‑time status tracking, cutting the waiting time from weeks to days.

After the incorporation paperwork, many tech‑focused startups must clear the National Office for Technology Acquisition and Promotion (NOTAP), the agency that reviews and approves technology‑related agreements and patents. NOTAP clearance is mandatory if your SME deals with software, telecommunications, or any patented process. Ignoring this step can stall funding applications and expose you to legal penalties, so it’s best to consult a compliance specialist early on.

Once you have the registration certificates, the next big advantage is access to SME funding and grants, government and donor programs that provide low‑interest loans, equity, and capacity‑building support to registered small businesses. Registration unlocks eligibility for the N500‑million SME Growth Fund, Central Bank of Nigeria credit facilities, and state‑level grant schemes. Moreover, a valid registration number qualifies you for tax incentives such as reduced corporate tax rates and VAT exemptions on certain capital goods. In short, the registration act is the gateway that enables you to tap into financial resources and fiscal relief.

Even after you’re officially registered, staying compliant is crucial. Regular filing of annual returns with the CAC, updating your tax status, and renewing NOTAP approvals where needed keep your SME in good standing. Many entrepreneurs overlook the importance of maintaining a clear record of shareholding and director appointments; this can cause delays when you later seek expansion financing or partnership deals. Using a simple compliance checklist – name reservation, incorporation, tax registration, NOTAP clearance, and annual return filing – helps you avoid costly penalties and keeps your business attractive to investors.

In the sections below you’ll find a curated set of articles that dive deeper into each part of the process: from securing your business name to navigating the latest funding programs and staying on top of regulatory updates. Use them as a step‑by‑step roadmap to turn your idea into a fully‑legitimate, growth‑ready MSME in Nigeria.

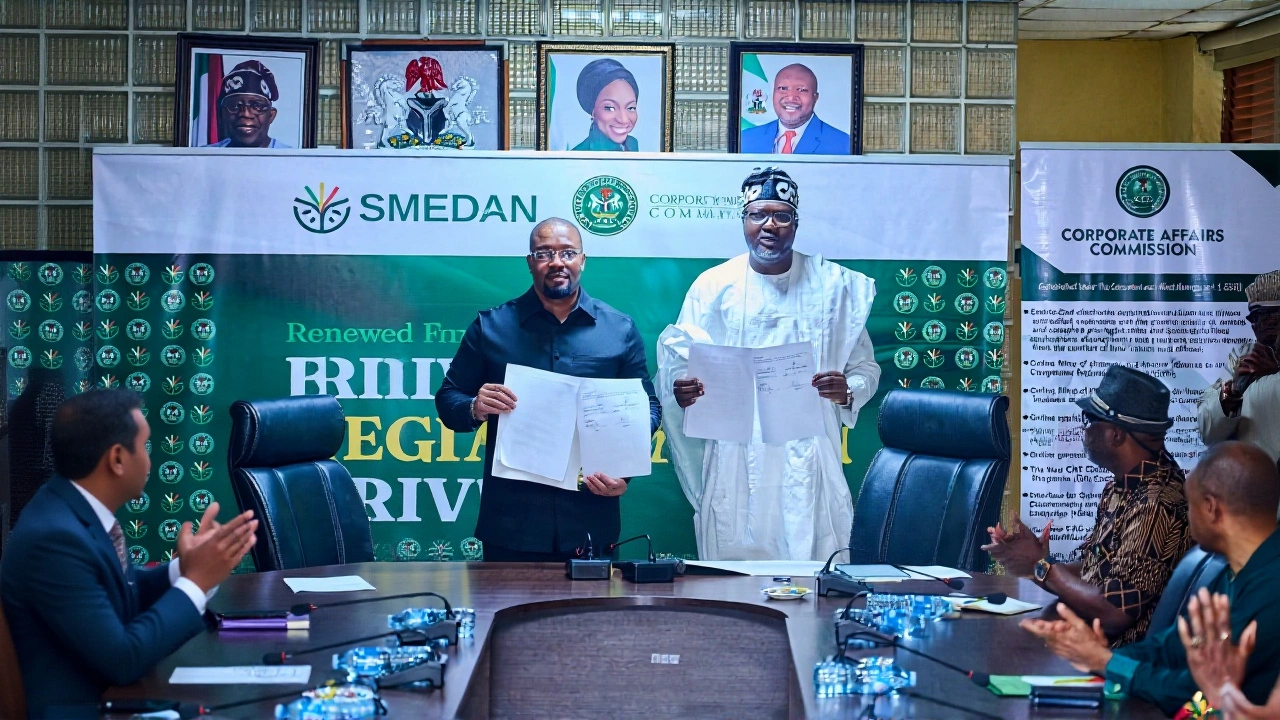

Nigeria's CAC & SMEDAN Offer Free Registration to 250,000 MSMEs

Nigeria’s CAC and SMEDAN launch a free registration scheme for 250,000 MSMEs, waiving ₦3 billion in fees to shift informal firms into the formal economy.